Absorption Rates

I wanted to dig a little deeper for today’s blog post and take a look at absorption rates in various condos. Looking at Festival Tower got me thinking about this subject. Festival Tower has a plethora of units available for sale, but hardly anything is actually selling. The building is stunning. The amenities are amazing, and the film festival that just finished put this tower in the international spotlight for a full 2 weeks. The building has been fully registered and finished for a few months now. I am at a loss as to why units are not moving here. There was so much hype about this building for the last 5 years, and now that it is finally finished, no one is buying?

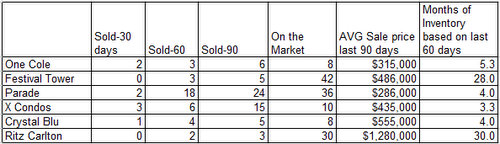

Let’s compare Festival Tower with other buildings downtown. I took a random sample of various buildings, all completed in the last 12 months. I tried to pick a few buildings to somewhat represent the whole spectrum of the downtown market from the lowest end to the highest end. Take a look at what I found:

Only 3 units have sold in the last 60 days at Festival Tower, and there are currently 42 units available for sale. At this rate, it would take 28 months to sell all available units! Similar story at The Ritz Carlton, where only 2 units have sold in the last 60 days and there are 30 units on the market (actually more since the developer has a few unsold that are not on MLS).

Compare this to a building like Parade in Cityplace, a known area for heavily investor-owned buildings. While there are a lot of units on the market in the building (36 currently), they are moving fast (18 sold in last 60 days)!

Obviously price point has a lot to do with this. There are far more buyers looking for condos in the $300K range than the $800K range. However, I am really starting to rethink the high-end of the market and wondering if there really is a market in this town for condos in the $800 per square foot and above price point.

You could possibly point to a building like Crystal Blu where the absorption rate is quite good and say there is a market but only in one area: Yorkville. One theory I have is people with money to burn on a condo will live in Yorkville, but anywhere else it’s not worth the premium to get a high-end unit.

The point of this blog post is really not to say I have an answer to this question about where are all the high-end buyers, but rather I would like to start a conversation with my readers and clients on the matter. So let me know your thoughts. Contact me or leave a comment.