Myth Busters: Renter’s Market Edition

Last week I came across this article in the Toronto Star written by Mark Weisleder whose headline claims that we are in a “Renter’s Market for Condos”. I had to scratch my head when I read that headline and I thought it was a typo. Reading through the article and the comments section was even more shocking because it seems that there are plenty of people out there that believe that we are in a renter’s market.

Please note: this blog post is not meant to be a critique of  Mark Weisleder or his article. Mark has written many great articles of late on the condo market and this latest article actually contains some great tips on things to include in a lease if you are a renter. I use Mark’s article simply as an example of the popular myth that Toronto is in a renter’s market.

The Basic Premise is Flawed

The basic premise of the renter’s market myth is something like this: “they are selling so many condos to investors that when these buildings finish they will flood the market with rental listings and you will be able to rent a brand new condo for dirt cheap”.

This premise is a close cousin to the ever pervasive “they are building too many condos (I see cranes everywhere), the market is over supplied and prices are going to crash 25-50%”.

These premises are ripe with assumptions and beliefs that are just not substantiated by the market itself. The new condo industry has basically been continuously running at full speed for a decade and in all this time we have not seen rental rates or prices fall with any significance (one exception being the recession of 2008-2009 when prices fell about 10%-but rents did not fall at all).

It is Clearly Not a Renter’s Market

Before I tell you why I think it is definitely not a renter’s market right now, but rather it is quite the opposite, let’s first define what we are talking about when we say renter’s market.

In a renter’s market,

There is an abundance of supply of properties to choose from for any given unit type, and for any given neighbourhood.

Renters hold the power in negotiations and can regularly negotiate rental prices that are below asking prices.

Units for rent would sit on the market for a long period of time before they are rented out.

Bidding wars for rental units are non existent.

It follows that in a landlord’s market, the opposite of these things would be true: shortage of supply, landlords hold the power, properties rent very quickly, bidding wars are common.

So what are we seeing in the Toronto condo rental market today?

Anecdotal evidence strongly suggests that it is not anything close to being a renter’s market in the downtown condo world. Ask anyone who has tried to rent a downtown condo in the last 6 months if they believe it is a renter’s market. Condos are routinely renting out the first day they are on the market. Landlords are being flooded with applications. Bidding wars are driving prices over asking. Stories of tenants paying in cash for six months or the entire year up front are even emerging. And as I have been blogging about for the past year, prices are going up.

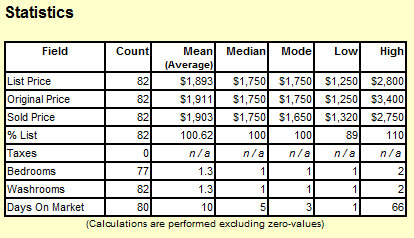

Statistical evidence (granted in somewhat short supply for the rental market in general) supports the anecdotal returns. I just did a MLS search of all the condos that had been leased out over the last week or so in the largest downtown sub-market (C01). I found that the actual rental price : asking rental price ratio was 100.6%. This means that on average, most condos are renting for more than the asking price. The average days on the market for these listings was only 10. So in barely a week, the average condo downtown is renting out for about $10/month over asking. Doesn’t exactly support the renter’s market hypothesis!

History of the Renter’s Market Myth

The “renter’s market due to condo over supply” myth is one that has been around for a long time in Toronto. People have been speculating that it is a renter’s market when clearly it is not for years!

See this Toronto Star article with a nearly identical headline to the article from last week dated May 2011. And see this blog post on a financial blog from February 2009 that also contains the basic and unsubstantiated premise (they are building so many condos therefore it will be a renter’s market).

Could Toronto Ever Become a Renter’s Market?

There may come a day where the condo rental market in Toronto is a renter’s market. In theory, this may come about because of an over supply of units that were pres0ld to investors, however, there is simply no evidence that I have seen to date that supports this will be the case any time soon.

I personally believe that as the resale market cools off in the second half of this year, we will continue to see upward pressure on rental rates as more would-be buyers continue to be renters, adding fuel to the already red hot fire of the condo rental market.

Thanks for Reading. Now what?

If you are a renter or a landlord and you have a story to share on the rental market for condos in Toronto, I’d love to hear it. Leave it in the comments below or send me an email.

If you liked this article, why not subscribe to receive updates, share it on twitter or facebook, or leave a comment below.

Or check out the rest of the Myth Busters series.