Three Interesting Tidbits From The August 2012 Condo Market Stats

The August sales figures are out from the Toronto Real Estate Board. Here is what I found most interesting:

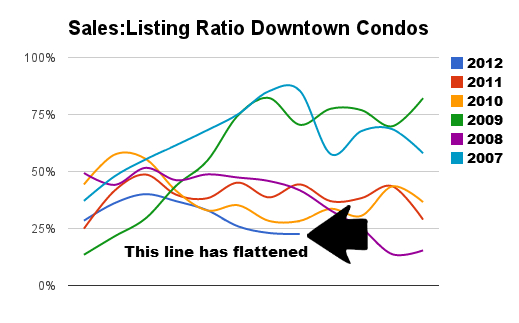

1. Sales:Listing Ratio Holds Steady

Those of you who read my stuff often know that this is my favourite statistic. The sales to listing ratio held steady at 23% in August-the same number as July. Sales are still down significantly over last year, but inventory growth is down too. The curve definitely seems to be flattening out.

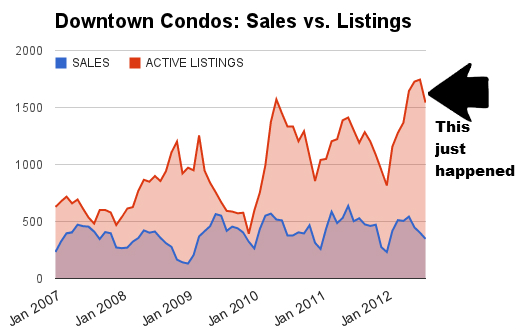

2. New Listings Are Down

We had 767 new listings added to the market in August. Last year in August we had 868 new listings added. That’s a drop of 12%. It seems that what I was predicting last month is already coming true: sellers are holding off selling.

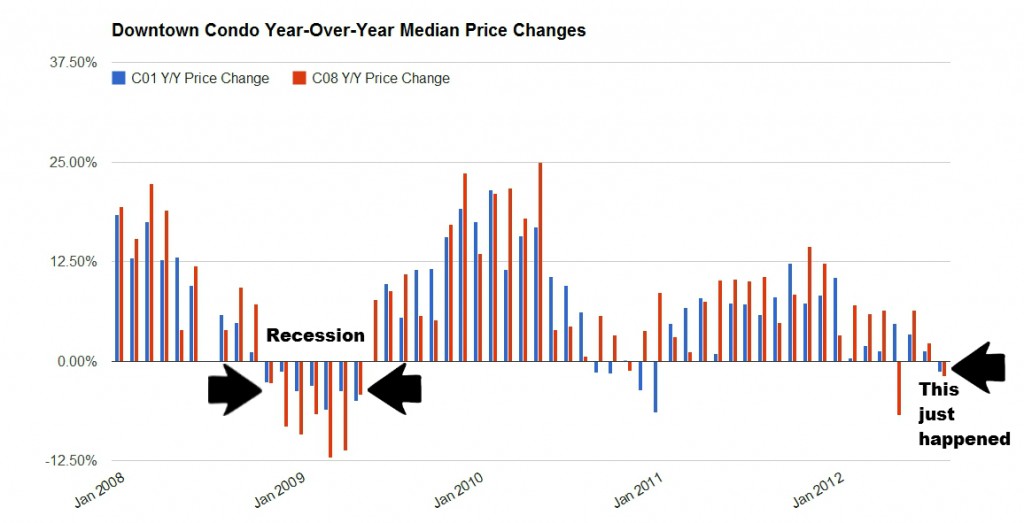

3. Prices Are Down

For the first time in a few years, median prices in both downtown sub-markets (C01 and C08) are down. Granted, the price decrease only amounts to 1% and 2% respectively but it is somewhat significant that this is the first time both have been in the red for the same month since the recession of 2008-2009.

Implications

The people of Toronto are some of the savviest real estate consumers on the planet. When they hear that the market is slowing down, they adapt accordingly. Sellers are holding off selling, the market is not being flooded with inventory as many of the doomsayers were predicting.

Evidence is growing to support the theory that we are in for a slower market, but not a crash. “Prices Down 1%” does not exactly make for a sexy headline on the front page of the business section.

I will continue to emphasize this message to buyers: the next six months are your window of opportunity. If inventory continues to trend down over the last 4 months of 2012, and prices remain flat or only slightly down, we could see prices spike in the spring market of 2013 as buyers reemerge en masse after waiting, waiting, waiting for a crash that will simply not happen in my opinion.

Like this article? Please become a True Condos Subscriber.